Source: Witthaya Prasongsin/Moment/Getty images.

The take

The appetite for graphics processing units (GPUs) and the compute resources built around them has increased dramatically due to the popularization of generative and agentic AI technologies.

AI technology and cloud infrastructure have consistently placed among the highest-scoring areas of enterprise technology spending intent, according to S&P Global Market Intelligence 451 Research’s Tech Demand Indicator. This illustrates the strength and consistency of the appetite for GPU resources.

That rapid increase in demand has caused difficulty in sourcing GPU components and finished servers. Demand from businesses unable to acquire sufficient chips to operate their own systems, along with many companies’ existing preference for public cloud infrastructure, has led to a boom in GPU-as-a-service (GPUaaS) cloud infrastructure offerings.

GPU-backed cloud instances have been a part of the hyperscale public cloud vendor portfolio for years. However, the sheer volume of demand and the hyperscalers’ relatively slow response gave rise to a new crop of GPUaaS specialist clouds and alternative providers focused on the generative AI opportunity, including AI tooling and the broader infrastructure stack.

Technical differentiators

GPU-driven cloud offerings may be technologically differentiated based on vendors’ choices in hardware and software, architectural and operational decisions, accompanying tools and the ways in which services are delivered and used.

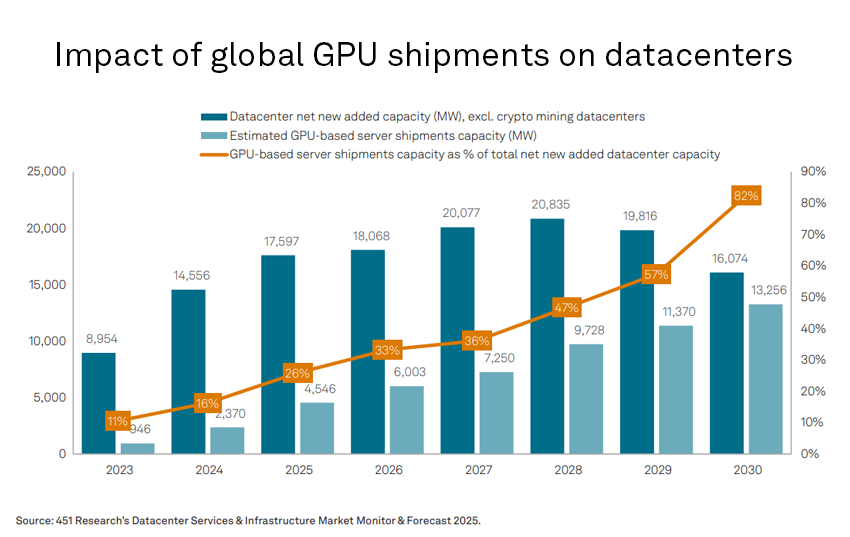

451 Research’s Datacenter KnowledgeBase (DCKB) projects global datacenter power demand to increase by 10%-15% annually through 2030, with a substantial portion of that demand driven by GPUs. Additionally, forecasts show GPU capacity will likely account for 82% of newly added datacenter capacity by 2030.

The above content is an excerpt from the first in a series of reports designed to provide usable insight for buyers of a particular technology category. The full report includes expert-driven analysis of relevant market context, trends and conditions; identifies critical selection criteria and relevant market-participating vendors; and provides critical information about those prospective vendors.

Reports such as this showcase insights derived from a variety of market-level research inputs, including vendor financial data, M&A information and other market data sources, both proprietary to S&P Global and publicly available. This input is combined with ongoing market observation and regular interaction with vendors, end users and other key market players.

You can read the full report here.

Help us make these reports more useful by providing your feedback via this brief survey.

Want more reports like this? Apply to join the 451 Alliance think tank. Participate in technology research that produces valuable industry insights you get in return.