Source: bjdlzx/iStock/Getty images.

As organizations seek to process data closer to where it is generated—whether on factory floors, in vehicles, or at retail locations—edge infrastructure is essential for enabling real-time responsiveness, reducing latency and supporting emerging technologies like AI and private 5G. Critically, edge is no longer just about infrastructure—it’s about enabling business transformation, according to a survey conducted by S&P Global Market Intelligence 451 Research.

Organizations are deploying edge infrastructure and services to enhance customer experience, optimize operations and unlock previously inaccessible use cases. Yet, as adoption grows, so do the challenges: Cost, security and performance remain persistent barriers. These findings reflect a market in transition: Edge is moving from experimentation to execution, and strategic clarity and vendor support will determine success.

The Take

For technology vendors, the edge landscape in 2025 is characterized by both opportunity and urgency. Organizations are investing in edge not just to modernize infrastructure, but also to enable high-value use cases — especially those tied to AI, automation and customer engagement. Vendors must recognize that edge is not a one-size-fits-all market. Solutions must be modular, secure and adaptable to a wide range of environments — from mobile field units to hyperscaler-operated zones. Implications include:

- Design for diversity: Organizations are deploying edge in datacenters, vehicles, retail outlets and cloud regions. Vendors must ensure their solutions can operate across this heterogeneous landscape.

- AI is the accelerant: AI-driven use cases are driving edge spending. Vendors should prioritize AI-ready infrastructure and services that can run inference at the edge with minimal latency.

- Security is a dealbreaker: Physical security and cybersecurity are top concerns. Vendors must embed robust, zero-trust security models into edge offerings.

- Support matters: Many organizations cite lack of skills and strategy as barriers. Vendors that offer strong onboarding, training and managed services will have a competitive edge.

- Think beyond infrastructure: The future of edge is in services, including analytics, orchestration and automation. Vendors can move up the stack to deliver value beyond hardware.

Summary of findings

Organizations’ sentiment points to a rapidly maturing edge computing landscape, where infrastructure is being deployed across diverse environments and powered by both traditional and emerging technologies. AI is catalyzing investment, use cases are expanding into customer-facing and predictive domains, and spending is rising sharply — even as cost, security and performance remain persistent barriers.

Edge spending is rising. A strong 68% of organizations report increased edge spending over the past year. Notably, 47% added AI requirements to their edge budgets, while 38% reallocated funds from other projects to support edge initiatives. This momentum signals that edge is becoming a strategic budget priority, particularly as organizations shift AI workloads from centralized cloud environments to the edge for faster, more context-aware processing.

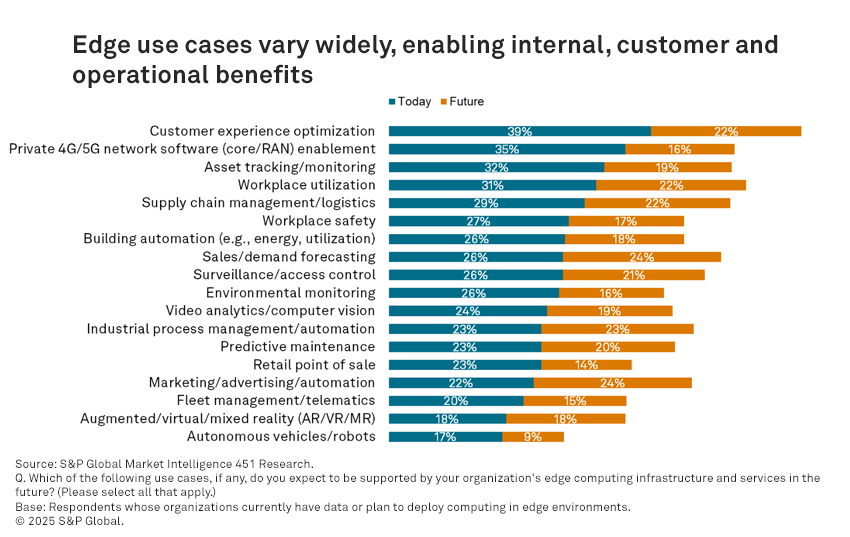

Customer experience is a top use case today. Edge computing increasingly drives business outcomes, with 39% of organizations citing customer experience optimization as a use case. Other leading applications include private 4G/5G network enablement (36%) and asset tracking or monitoring (32%). This shows that edge is not just about IT efficiency — it’s about enabling real-time, data-driven services that directly impact customer satisfaction and operational agility. Looking ahead, 24% of organizations expect to support marketing/advertising automation and surveillance/access control through edge deployments. Predictive maintenance (23%) and customer experience optimization (23%) also rank high on roadmaps. These projections suggest that edge computing is evolving into a platform for advanced analytics and automation, particularly in areas requiring real-time responsiveness and localized data processing.

AI is the No. 1 driver of edge investment. Nearly 60% of organizations cite new AI edge deployments as a primary reason for increased spending, followed by general infrastructure upgrades at 51%. This trend reflects the growing importance of AI workloads at the edge, where low-latency inference and localized decision-making are critical. Vendors must ensure their solutions are AI-ready, supporting everything from model deployment to life-cycle management in distributed environments.

Cost and security dominate concerns. Cost remains the most cited barrier to edge adoption, flagged by 43% of respondents. Security concerns — both cyber (37%) and physical (30%) — also weigh on decision-makers. These challenges highlight the need for vendors to deliver cost-effective, secure solutions that reduce total cost of ownership while addressing the unique risks of distributed infrastructure.

Organization-operated datacenters lead edge deployments. More than half of respondents (56%) include organization-operated, on-premises datacenters in their edge strategies, making them the most common edge environment. Mobile environments such as vehicles or field equipment follow at 47%, while hyperscale public cloud infrastructure is cited by 42% of organizations. This distribution underscores that edge computing is not limited to the network periphery; it spans a hybrid mix of traditional, mobile and cloud-based environments, reflecting the flexibility organizations need to support diverse workloads and use cases.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.