Source: clu/iStock/Getty images.

Edge computing is no longer an experiment — it is becoming a structural pillar of organizations’ IT strategy. As organizations scale distributed infrastructure to support real-time data processing, automation and AI workloads, edge deployments are moving from pilot to production. A recent study conducted by S&P Global Market Intelligence 451 Research reveals a market in transition: Budgets are expanding, managed services are gaining traction, and AI is reshaping investment priorities. Yet, edge still represents a modest portion of overall IT spending for most, and budget ownership remains fragmented. The key theme emerging is one of pragmatic acceleration — organizations are scaling edge with purpose, but not without caution.

The Take

Vendors targeting the edge infrastructure and services market must navigate a landscape defined by fragmentation, incrementalism and rising expectations. While edge adoption is accelerating, most deployments remain modest in scale and budget. Procurement models are split between capital expenditures and operating expenses, and decision-making authority is often diffused across departments. This calls for flexible engagement strategies and modular offerings that align with varied financial and operational preferences.

The growing influence of AI at the edge — cited by 51% of respondents as a driver of new budget allocation — signals a need for solutions that are AI-ready by design, accounting for smaller models and more distributed AI data pipelines deployed to the edge.

Meanwhile, the rise of managed services points to a market increasingly open to outsourcing complexity. Vendors should prioritize interoperability, security and service integration to meet organization’s demands for scalable, secure and cost-efficient edge deployments.

Summary of findings

Edge spending is rising steadily. More than three-fourths (78%) of organizations expect their edge infrastructure and services spending to increase in 2025 compared to 2024, with 25% anticipating a significant increase. This upward trend reflects growing confidence in return on investment from edge implementations and recognition of edge technologies’ role in digital transformation. The data indicates that edge is becoming a priority investment area across industries.

Most edge spending is still modest. Only 6% of respondents say that nearly all (76%-100%) of their IT spending is associated with edge deployments. The largest proportion (40%) report that edge accounts for 26%-50% of IT spending. This suggests that while edge is growing, it remains a relatively small slice of overall IT budgets, indicating room for expansion.

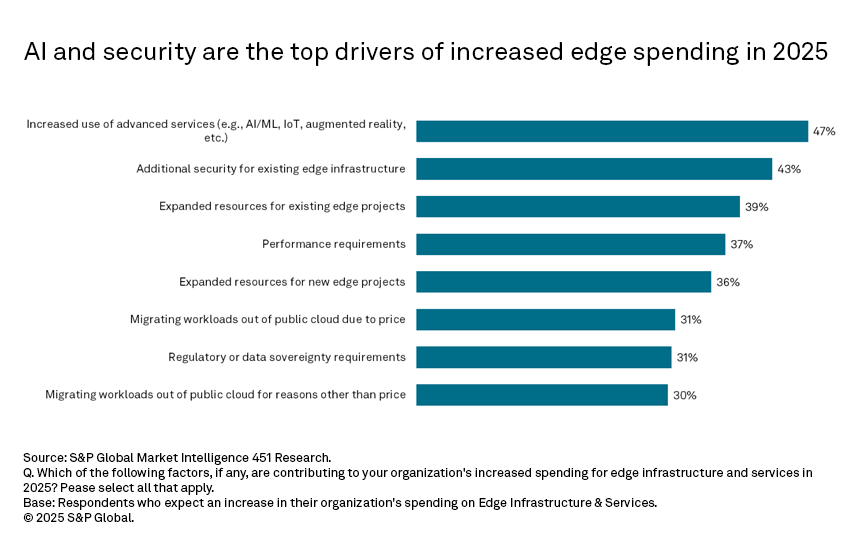

AI is a leading driver of edge investment. Just over half (51%) of respondents say that AI edge requirements are adding to budgets originally planned for other edge projects. While not the only factor — security and project expansion are also key drivers — AI is clearly reshaping how organizations prioritize and allocate edge resources.

Managed services are gaining traction. Two in five respondents (41%) expect to increase spending on managed edge services delivered by providers on-premises. This reflects a shift toward outsourcing edge operations to third parties, likely driven by the need for specialized expertise and operational efficiency. Organizations are looking for partners to help scale edge deployments.

Capex vs. opex preferences are about evenly split. When asked about preferred spending models, 39% favor capital expenditures, 35% prefer operating expenditures, and 27% have no preference. This balance suggests that organizations are approaching edge deployments with flexibility, but also that financial planning models for edge are still evolving.

Budget ownership remains fragmented. Only 56% of respondents say edge spending comes at least partially from a dedicated edge budget, while 44% report it comes from other areas of the IT budget. This lack of centralized budget control may hinder strategic planning and cross-functional alignment. It also suggests that edge initiatives are still being absorbed into broader IT operations rather than treated as stand-alone programs.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.