Source: MASTER/Moment via Getty images.

The first two years of the generative AI revolution have seen a whirlwind of unprecedented changes in both the data center and energy sectors. These changes have led to many questions about how the industry will move forward. S&P Global Market Intelligence 451 Research recently hosted a webinar in which a team of experts addressed a variety of conceptions swirling in the industry and offered their opinions on whether they are truth, myth or lie somewhere in between.

The Take

The GenAI revolution has been a source of scrutiny and speculation. While hyperscalers have slowed in some areas, spending on infrastructure development is on the rise and will likely continue to increase. Amid this growth, speculation around sustainable power remains a top topic. The feasibility of operating data centers solely on wind and solar with battery storage is low, largely due to the unpredictable and inconsistent nature of those resources. Data center operators will likely need to pursue other options. With this in mind, operators are leaning more toward “clean power” rather than the traditional “green power” mindset.

Policy will likely dictate what type of power is available, how much data centers can consume, where it is available and how much it will cost to build in those areas. We anticipate a rise in policies — particularly in the US — that hold operators financially accountable for the transmission and distribution upgrades to the grid and for the amount of power they request. This is a huge shift from when power suppliers were willing to entertain future plans from data centers on a handshake. It is largely attributable to the dot-com bubble, when utilities built out on the promise of data centers for exponential growth, resulting in a decade-long oversupply of grids across the country.

Truth or myth?

Our team of experts was composed of Tony Lenoir, an associate director focused on the power and renewables space; Adam Wilson, a senior principal analyst specializing in wind, solar and energy storage research; and Dan Thompson, a principal research analyst who leads our data center services and infrastructure team and is charged with keeping tabs on data center trends globally. In the webinar, they addressed the following concerns:

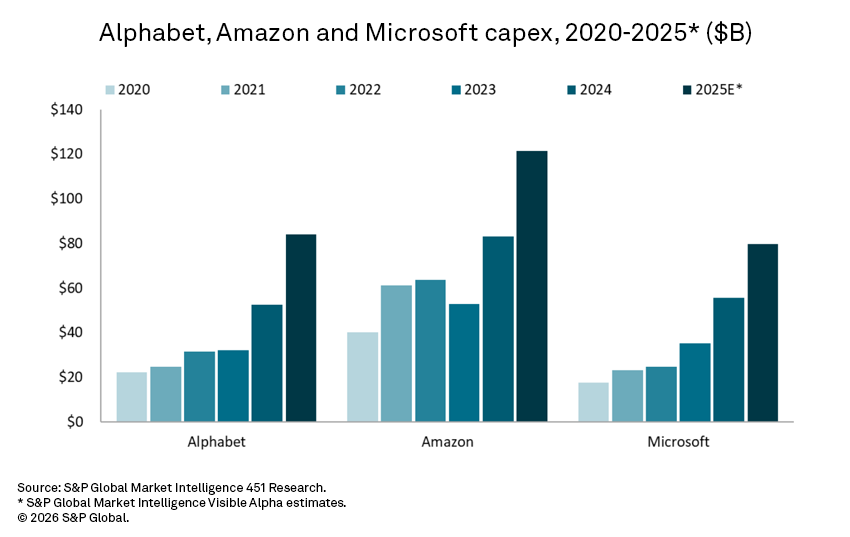

Hyperscalers have put the brakes on data center development

This one is true, but it requires quite a bit of context. Depending on where you are in the world, you may believe this is a myth. There definitely are several projects across the globe that have been paused. At the same time, several projects continue to go forward. Alphabet Inc., Amazon.com Inc. and Microsoft Corp. have been ramping up capital expenditures with year-over-year increases of 13%, 16% and 27%, respectively. While capex includes more than just data centers, if you listen to companies’ earnings calls, they have said repeatedly that a significant portion comes from data centers and other AI-related infrastructure. Other hyperscalers such as Meta Platforms Inc., Oracle Corp. and Apple Inc. have made similar statements.

If everyone is still spending and growing, what exactly happened to the slowdown? Rumblings began late last year of strained relations between OpenAI and Microsoft. Shortly thereafter, a project in Wisconsin was paused, which was rumored to be for OpenAI. As the tensions between the two became more public, so did reports of slowdowns and pauses. It seems that these slowdowns may have been a product of uncertainty in this key relationship.

Since this has all played out and new partnerships have emerged, some of the projects in Wisconsin and Ohio have begun to move forward. Builds in North Carolina still appear to be frozen, however. It seems that utilities are having challenges in the state delivering power in a timely manner. We have seen companies that were going to build in North Carolina move the project because they could get power faster elsewhere. Overall, this seems to be a result of business decisions due to changes in relationships mixed with strained power availabilities. Microsoft recently disclosed that two gigawatts of capacity has come online over the past year, so it doesn’t appear to be slowing down much.

With less emphasis on solar and wind, hyperscalers have curtailed renewable investments

This is a pretty easy one for the time being — it is a myth. Our most recent midyear update of corporate clean-energy procurement shows that from February to mid-July, corporations signed over 10 GW worth of wind and solar deals in the US alone. About 80% of that 10 GW is from the technology and web services sector, with most of the buyers being hyperscalers Google, Amazon, Microsoft and Meta.

It is possible that this could change due to tax credit phaseouts and other hurdles in the new US budget legislation. It is also reasonable to expect a slowdown in the future, but it likely won’t be significant. Moreover, we are noting interest in different kinds of clean energy such as nuclear, hydroelectric and geothermal. This is not necessarily correlated to tax phaseouts but to companies’ energy goals and the desire for less intermittent forms of clean energy. As of now, there should be no slowdown, but that could change over the next few years.

Can data centers rely on wind or solar with batteries for energy needs?

It is theoretically possible for a data center to be powered by wind and solar alone. However, the amount of overbuild makes it unfeasible. In any real-world functional sense, operators cannot rely on just wind and solar for power, even with batteries. It creates too many challenges: If there is a cloudy or windless day, for example, there might not be enough power to keep the facility up and running. Most companies are not investing in wind or solar plugged directly into a data center, but are putting these resources into the grid and purchasing credits to offset emissions.

Policy can play a major role in both data center and energy development

From an energy perspective, this is absolutely true. The tax credit phaseouts and hurdles in the new US budget legislation will play a role in wind, solar and battery deployments. Battery storage was spared for the most part in terms of tax credit phaseouts, but that sector will still take a hit due to “foreign entities of concern” restrictions, particularly in China and other countries that fall within those restrictions.

There inevitably will be a curtailment of wind and solar development, but that isn’t going to kill those industries. While costs will go up, this will likely make wind and solar technologies more dependent on location. Developers will have to be more cognizant of where to build and what makes sense economically. This should also limit the pool of resources that data center operators have to tap into, which could lead to less direct power purchase agreements located in the same grid system and more virtual power purchase agreements. Ultimately, with the way things are going, there are hurdles for all technologies.

This is also true from a data center perspective, and has gained importance more recently. A few years ago, companies were developing in states that had tax incentives for data centers, but those incentives were considered more as “icing on the cake.” Now that investments have gone well into the billions, tax incentives have become a much more important consideration when choosing where to build.

For example, Georgia passed a bill in 2024 to get rid of state incentives for data centers, which was ultimately vetoed by the governor. While this was happening, there were rumblings around the hyperscalers abating development in Georgia until everything played out. This is top of mind, and it is easy to see why saving a few percentage points on multibillion-dollar investments makes a substantial impact on an organization’s bottom line.

Companies are rethinking sustainability targets in the face of the AI arms race

It is unlikely that companies will retreat from previous sustainability goals, but it is possible that some of the more aggressive targets such as carbon-free or carbon-negative emissions could see timelines extended. The combined power consumption of Google, Meta and Microsoft, for example, has more than doubled since 2020. For Google and Meta, 95% or more of that consumption is coming from data centers. With all of the growth these companies are seeing, it is a significant challenge to keep up with renewable purchases while adopting an “all of the above” approach to getting power.

From an enterprise perspective, we are also not witnessing a backdown on sustainability. According to our survey data, enterprises are consistently asking the hyperscalers to engage in sustainable activities, because the enterprises themselves are working toward their own sustainability goals. As such, it is likely a myth that sustainability targets will see drastic alteration — that said, we could see other technologies or methods of carbon offset come into play as tax credits for wind and solar are discontinued.

Only hyperscale-level deployments are having trouble procuring power

Some of the surveys conducted by S&P Global Market Intelligence 451 Research inquired about the availability of power and challenges that organizations are noting. The results demonstrate that the majority of both enterprises and service providers consider the availability of power a challenge. The leading challenge noted by both groups was paying a higher cost for energy utilities. Many also have shifted toward on-site power generation. Importantly, these findings were maintained across deployment size — the size of the organization did not seem related to viewing power availability as a central challenge.

Future facilities will need to be AI data centers and will consume significantly more energy

Anytime the word “all” is evoked, it will probably be a myth — it will be true for a significant portion, however. By 2029, as much as 60% of data center power could be devoted to GPU-based compute. This has not yet been parsed out by different parts of the AI life cycle such as training and inference. We maintain that it is too early to make predictions about how these AI data centers will play out in the long run. AI facilities are consuming more energy. Will they all continue to do so? Probably not, but there is currently an increase in the amount of data centers that consume significant amounts of power.

Want insights on datacenter trends delivered to your inbox? Join the 451 Alliance.