Source: Getty Images.

This year’s Quantum.Tech USA showcased the accelerating momentum behind quantum technology, bringing together industry experts, external partners and government leaders from around the world. While there was plenty of celebration of quantum’s progress to date, it was balanced by a hefty focus on the challenges remaining for the still-young industry. The urgency for continued research and investment in quantum technologies was underscored by a focus on national quantum initiatives and a full day dedicated to quantum’s impact on cybersecurity, while many of the keynote sessions also discussed the need for a more robust talent pipeline to support the anticipated growth of the industry.

The Take

Quantum-centric events and conferences offer excellent insight into the state of the industry as a whole. Smaller than other tech events, quantum conferences generally focus on the technical aspects of the industry, at times feeling more like scientific conferences than venues for product demonstrations or sales pitches. Quantum is, in many ways, still trying to figure out how to market itself — how to make the leap from academia into tech and business, and crucially, how to bring in customers in the process. This year’s Quantum.Tech pushed the boundaries a bit, hosting a range of end-user presenters and government representatives to expand the reach of the event’s audience. Although pieces of the quantum story are making their way to the outside world, there is still a notable communication gap between the conversations happening in the room and the takeaways being surfaced to outside observers. Quantum technology vendors will need to settle into their story, their audience and their outreach if they are to bridge that gap.

Context

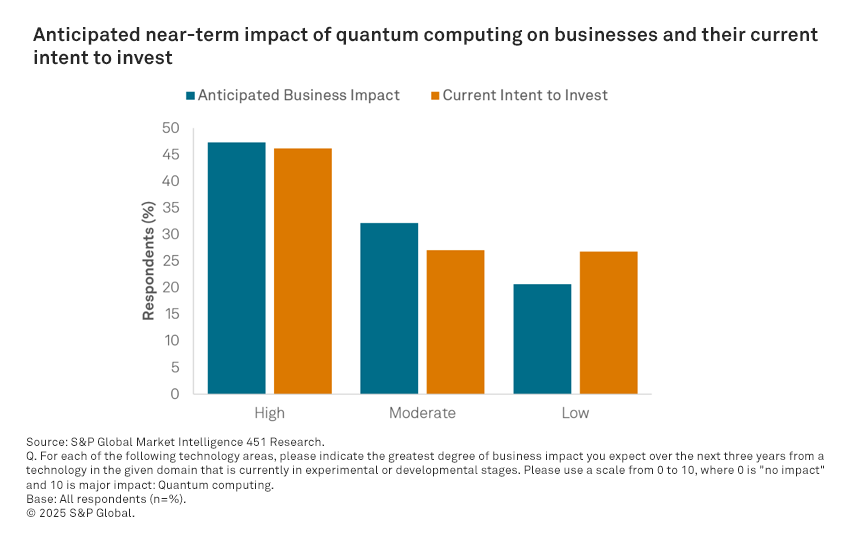

The past year has marked a watershed moment in the field of quantum technology, with recent advances and global initiatives piquing public interest and injecting both optimism and urgency into the space. Public perception around quantum computing specifically is very high: respondents to a study conducted by S&P Global Market Intelligence 451 Research overwhelmingly anticipate quantum computing (QC) will have at least a moderate business impact within the next three years, with more than 47% of survey respondents projecting that QC will have a high impact in that time.

Even with this new surge in public optimism, however, there is still notable hesitation among non-quantum industries to engage with the technology. Intent to invest in QC lags behind its anticipated business impact, and even those who anticipate quantum computing will have a near-term, high business impact are not always planning to invest in the technology immediately.

At Quantum.Tech USA and other conferences, this disparity is inevitably a major topic of discussion on panels and in conversations. Industry insiders point to a communication gap from the industry outward, with causes ranging from the knotty subject matter to an industry-wide hesitancy to “hype up” the technology prematurely. The year 2025 has brought with it an increased emphasis on tackling this communication gap and encouraging a wider audience to start placing their bets on quantum in a real way. Quantum CEOs have spent the last several weeks testifying before the US Congress in support of the National Quantum Initiative; QC companies spent the first half of the year announcing back-to-back product releases; and at Quantum.Tech USA, the focus was overwhelmingly on quantum’s potential as a technology, its recent and rapid progress, and the next steps needed to support the continued growth of the industry.

Key themes and takeaways

At the three-day conference, several key themes emerged from the panels, discussions and conversations held throughout the venue.

Cryptography and cybersecurity were highlight topics of the conference, with the entirety of the first day designated as a “Cryptography Spotlight Day” for attendees. The discussions and conversations surrounding quantum’s impact on the cybersecurity space spilled over into the rest of the conference as well — which is perhaps not much of a surprise. While quantum computing has a lot of positive potential to tackle big problems, progress in the technology also has a dark side: powerful enough quantum computers are projected to be able to break current encryption methods, meaning that leadership in quantum computing is not just a technical “nice to have,” but a national security issue. Given the rapid progress of quantum computing power over the past few months alone, there has been a heightened sense of urgency behind efforts to develop and implement quantum-proof encryption methods and shore up national quantum capabilities. There has also been more discussion around areas that might be particularly vulnerable to quantum computer attacks, including the bitcoin blockchain.

Government investment was also a key theme of Quantum.Tech, with speakers using the conference’s location in Washington, DC to highlight the importance of government funding and support for the still-young quantum computing industry. While much of the conversation was North America- and Europe-centric, there was also representation from some of the newest geographic entrants into the QC space, with Brazil’s Director of Technology and Ministry of Foreign Affairs, Eugenio Vargas Garcia, presenting on a panel covering global perspectives on quantum technologies. Most of the need driving government investment in quantum technologies seems tied to worries about national security, with the Ambassador of Denmark to the United States, Jesper Moller Sorensen, notably warning that “technologies that protect us can also be used against us.” Emphasis was placed on fostering and maintaining strong collaboration across allied borders to help combat the potential for non-Western quantum supremacy.

Fostering quantum talent is of ongoing importance to the quantum technology space and was mentioned again and again in panels and discussions at Quantum.Tech. Quantum computing in its current iteration requires a unique and highly technical skill set, with current employees at quantum vendors often equipped with a Ph.D. in physics, quantum mechanics, photonics or other advanced scientific degrees. As quantum begins to scale, there is concern that the lack of a quantum-skilled workforce could eventually become a key limiting factor in the overall progress of the industry. To combat this possibility, many quantum vendors have collaborated with educational institutions to help develop curriculum, host hackathons and fund educational outreach opportunities. There has also been a push throughout the industry to develop bridge technologies to help make quantum computers more accessible to today’s classically trained computer scientists and engineers, minimizing the need to retrain those workers in deep science.

Artificial intelligence is everywhere these days — and that includes in quantum technology. Most of the panels’ Q&A sessions at Quantum.Tech included at least one question from the audience about the potential impact of AI on quantum computing and vice versa. Near-term, generative AI approaches might prove useful in the continued development of quantum computers, accelerating the progress of quantum hardware or, more realistically, improving the software interfaces between quantum machines and classical systems. Companies like Microsoft Corp. and NVIDIA Corp. are pushing hard on the quantum/AI opportunity in hopes that their lead in AI will naturally segue into a lead in quantum computing as well. For the long term, experts are targeting hybrid classical/quantum/AI systems to help address some of the concerns currently being surfaced around AI’s energy usage. Hybrid compute systems leveraging next-generation quantum computers could theoretically be more energy efficient than AI or classical supercomputers on their own, potentially helping alleviate some of the projected strain on global power demand due to increased AI usage.

Scaling continues to be a quantum keyword: even though the past year has seen a rapid increase in the size and power of quantum systems, the race is nowhere near finished. More powerful systems remain the order of the day, and they will come only through a combination of larger qubit configurations and more performant qubits. Several discussions at Quantum.Tech centered on the current state of quantum computers and projected road maps for computer sizes moving forward. Industry voices generally estimate commercially useful quantum systems will be developed within the next three to five years, although there are many caveats in place: for one, quantum annealers (a type of narrowly useful quantum computer) are already being used commercially; progress in quantum computing has grown more rapidly over the past year than expected; and of course, quantum’s “ChatGPT moment” may not arrive with one big bang of adoption, but might instead grow over a sustained period of several years. In any case, the near future holds the promise of larger, more powerful and more useful quantum computers.

Quantum tech in the boardroom

In addition to discussing the progress of quantum technology from a technical standpoint, Quantum.Tech USA focused heavily on the end-user side of quantum. Executives from a variety of companies, including The Boeing Co., Airbus SE, HSBC and Schneider Electric SE took to the stage to talk about why quantum is a boardroom topic — and what their experience has been as early adopters of the technology. Discussions focused on pilot programs within the companies, internal R&D initiatives, return on investment of quantum today and in the future and what the quantum adoption process looks like.

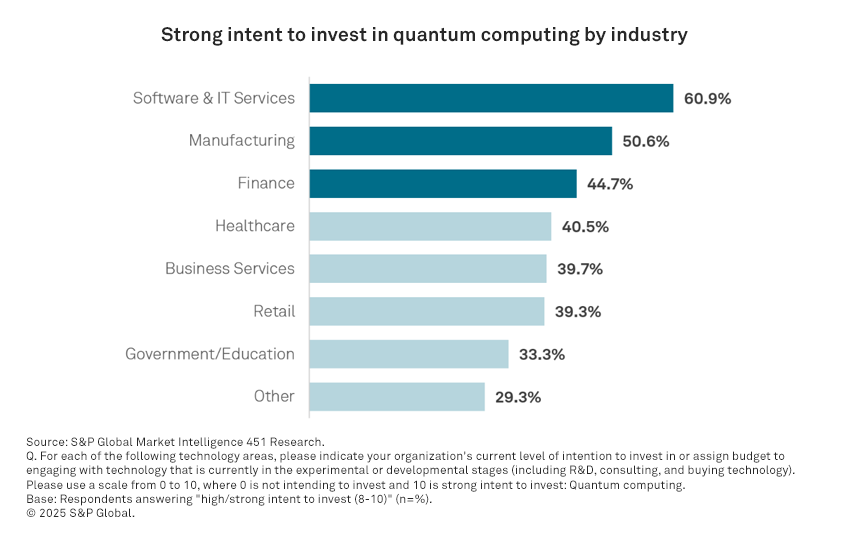

Some industries have been more eager to test out early quantum systems than others — finance, manufacturing and healthcare are often touted as being particularly good fits for quantum use cases. This tracks in a recent study conducted by S&P Global Market Intelligence 451 Research, which found that the industries most likely to indicate a strong intent to invest in quantum computing include software and IT services, manufacturing and finance, with healthcare a near fourth.

In addition to the corporate presenters mentioned, Quantum.Tech also hosted representatives from Samsung Electronics Co. Ltd, Pfizer Inc., JPMorgan Chase & Co., Moody’s Corp., Johnson & Johnson, Wells Fargo & Co., Collins Aerospace, Honda Research Institute Europe, BP PLC and more.

What to watch next

As quantum technology continues to advance, the next several months will no doubt be full of product announcements, scientific achievements and corporate business throughout the industry. Some key indicators we are keeping an eye on in quantum include the following:

- Additional funding rounds (particularly series B or later).

- Legislation surrounding quantum technology, quantum computing and quantum-safe encryption.

- M&A activity within the startup landscape.

- The initial public offering of quantum companies.

- Quantum networking progress and announcements.

- The opening of new quantum datacenters.

- The availability of additional quantum computers via the cloud.

- New, center-stage uses of quantum computers (particularly from commercial partnerships).

- Adherence of vendors to published developmental road maps.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.