Source: key05/iStock/Getty images.

Global decarbonization will likely be more difficult, more expensive and less linear than earlier projections suggested. The transition is inherently multidimensional, and is advancing unevenly across regions and combines growth in renewables with continued reliance on fossil fuels. Transforming the global energy system will demand unprecedented capital, significant technological innovation and a delicate balancing of economic, security and climate priorities.

Technology will likely be a critical enabler — supporting the electrification of public infrastructure. Among the most impactful approaches are behind-the-meter solutions, which place energy generation, storage and management technologies at the point of consumption. For governments, deploying behind-the-meter systems allows public buildings and infrastructure to generate, store and optimize their own energy. This reduces dependency on the wider grid, enhances government and site energy resilience, and accelerates decarbonization efforts without relying only on utility scale investment.

The Take

Governments often find themselves balancing a confluence of priorities — striving to lean into the energy transition and electrify buildings and assets to reduce emissions, while grappling with limited budgets and legacy infrastructure. As the private sector advances its own energy transition, it will likely play a critical role in supporting local, state and federal governments on a parallel path through technology deployments, innovative funding mechanisms and strategic collaboration.

Behind-the-meter (BTM) deployments are an example of this collaboration in action, providing opportunities for public-private partnerships, performance-based service models and alternative financing that reduce up-front costs while delivering energy cost savings and resilience benefits. From the utility perspective, these government moves at the grid edge also shape future system reliability and demand coordination, underscoring the need for closer integration between BTM assets and grid operation.

Government transition priorities

The global energy transition refers to the phasing out of fossil fuels in favor of cleaner, more sustainable energy sources such as wind, solar, hydro and other low-carbon technologies. This shift aims to reduce greenhouse gas emissions, combat climate change and build more resilient, efficient and decentralized energy systems.

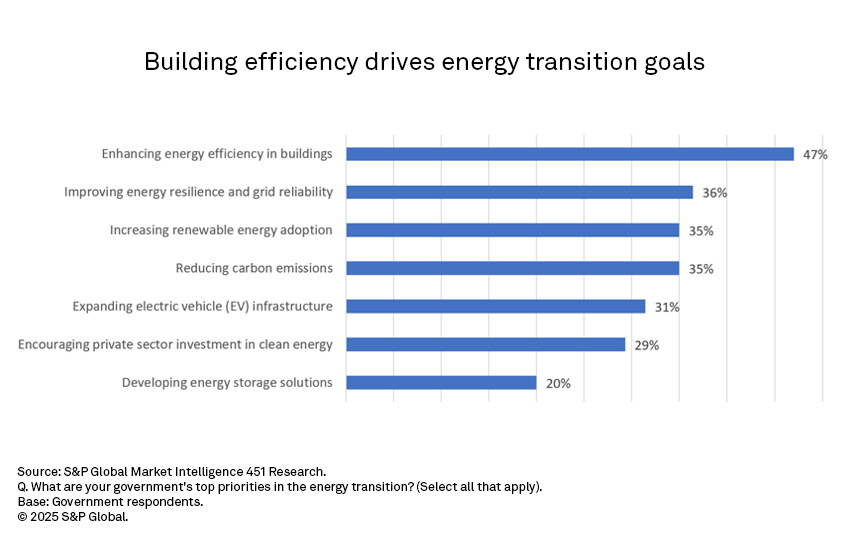

According to a study conducted by S&P Global Market Intelligence 451 Research which focused on use cases and outcomes in the IoT market, specifically the operational technology (OT) perspective, governments have looked toward a variety of enabling technologies to facilitate their participation in the transition, driven by goals of efficiency and resilience.

Enhancing energy efficiency in buildings (47%) is the top priority for government respondents, signaling a strong focus on improving building energy performance. This emphasis reflects the sector’s significant share of energy consumption and emissions, with buildings contributing to 30% of global final energy consumption according to the International Energy Agency. Government efforts to achieve efficiencies often align with frameworks and mandates such as the WELL Building Standard, Building Research Establishment Environmental Assessment Method, ENERGY STAR or local policies like New York City’s Local Law 97, which require buildings to meet specific energy and carbon benchmarks. Energy management systems integrated with BTM assets such as solar arrays and battery storage can enable real-time data-driven optimization and demand flexibility to drive efficiency gains in public buildings.

Improving energy resilience and grid reliability (36%) indicates a growing concern around energy stability. Amid climate change, electrification and rising energy demand, improving resilience emphasizes the dual goal of reducing emissions while maintaining service continuity. Investing in on-site generation and storage for buildings via battery energy storage systems, advanced energy management systems and virtual power plant participation are among the strategies that government buildings can leverage to ensure business resilience and continuity during periods of instability.

Increasing renewable energy adoption (35%) and reducing carbon emissions (35%) are foundational goals of the energy transition.

These goals reflect long-term policy ambitions but may face slower execution compared with short-term efficiency upgrade due to regulatory hurdles, cost barriers and skilled staff shortages. Behind-the-meter renewable generation like rooftop solar is a direct and scalable way for governments to expand clean energy capacity on-site. Coupling renewables with battery storage systems maximizes clean energy utilization and reduces reliance on fossil fuel backup power.

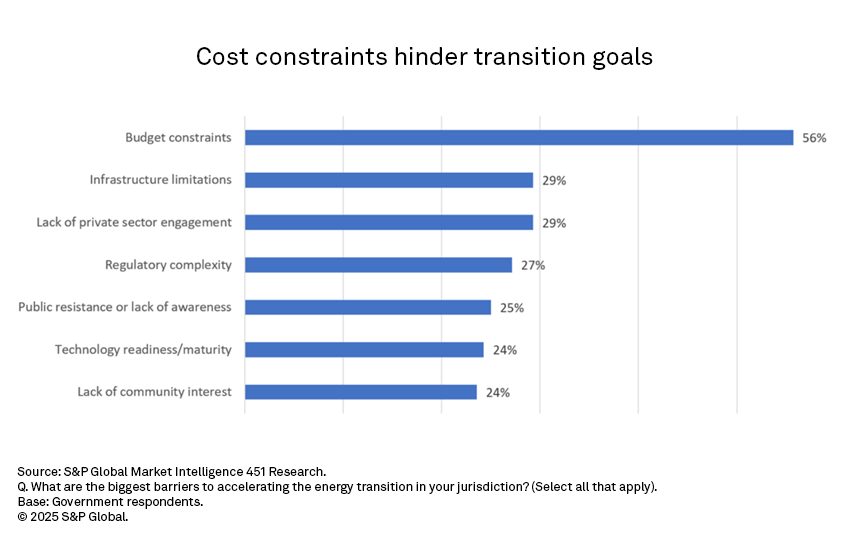

Barriers to execution

Despite a broad interest in achieving electrification and phasing out fossil fuels, governments are challenged to execute on goals due to cost concerns, legacy infrastructure hurdles and lack of participation from private sector, capital-providing partners. Vendors can assuage some of these concerns through collaboration and shared funding models for energy infrastructure upgrades, alternative service models favoring capex approaches and in sharing the navigation of complex, evolving regulatory mandates.

Budget constraints remain the dominant barrier to the energy transition, with more than half of respondents (56% of governments) viewing limited financial resources as the primary obstacle. While climate ambition is high, execution may falter without sufficient capital. BTM solutions may offer cost-saving opportunities by lowering energy consumption from the grid and enabling innovative financing models such as energy-as-a-service that minimize up-front capital investments (Redaptive is one such company adopting EaaS for customers). Public–private partnerships leveraging BTM assets can provide scalable paths to implementation.

Infrastructure limitations, including aging or a lack of energy infrastructure, are a challenge for close to a third of respondents. Aging grids, limited EV charging networks (or lack of grant availability to build out electric vehicle charging infrastructure) and insufficient renewable integration capacity continue to hinder deployment. To that end, governments may need to prioritize “hard tech” upgrades — transmission lines, district heating, storage — alongside clean tech adoption.

The lack of private sector engagement (29%) indicates a gap between public policy and private implementation. Governments should work toward creating enabling environments — stable incentives, procurement models, permitting reforms — to attract private investment. Private sector partners can explore alternative service models, like capex approaches that reduce or eliminate the up-front costs associated with LED replacements or HVAC upgrades, for example, and get paid back when energy savings are achieved.

Navigating regulatory complexity can hinder deployments for governments without the resources to learn and implement around local and federal legislation. Fragmented rules, permitting bottlenecks and overlapping jurisdictions stall projects. Streamlining regulatory processes is just as critical as funding, especially for distributed energy resources (DERs), microgrids and building electrification. Vendors that can educate end users and adapt offers to local laws, like Local Law 99 in New York, may see more success.

While technology readiness is a direct concern for only 24% of government respondents, many other barriers — such as infrastructure limitations, regulatory complexity and lack of awareness — are indirectly shaped by how emerging technologies are developed, deployed and communicated. Governments must move beyond policy ambition and actively shape technology pathways through targeted investments in digital infrastructure (data, sensors, connectivity) and by modernizing regulation for dynamic, tech‑driven energy systems.

Within this context, behind‑the‑meter energy solutions are becoming an essential pillar of government energy transition strategies. By localizing energy generation and storage, enhancing efficiency and enabling resilience, BTM investments complement broader clean energy infrastructure. They offer practical, cost‑effective mechanisms for advancing decarbonization, reliability and fiscal sustainability, while giving governments the capacity and agility to translate climate ambition into on‑the‑ground results.

The utility perspective

For utilities, the energy transition is defined by a single challenge: maintaining grid stability in an increasingly complex environment. Their core task — matching supply and demand in real time — has grown far more difficult as electrification, EV charging and AI datacenters drive load growth, while climate change disrupts predictable seasonal patterns. What was once manageable with steady forecasts is now unpredictable, with capacity constraints surfacing across the system.

Much of this complexity arises at the grid edge, where BTM solutions such as rooftop solar, home battery energy storage and advanced energy management platforms are proliferating. These assets provide resilience and decarbonization benefits for governments and consumers, but for utilities they are not a straightforward solution. A lack of visibility into BTM systems makes it hard to forecast their contribution or anticipate sudden spikes in demand. Without integration, grid-edge growth risks undermining rather than supporting stability.

Integration is therefore critical. Aggregated home batteries, coordinated through virtual power plants (VPPs), can help absorb oversupply from renewables and release energy during peak demand. Bundling BTM generation and storage into microgrids — or “energy islands” — offers resilience for communities while also providing flexible resources to the wider grid. When coordinated, these distributed resources shift from being unpredictable liabilities to becoming valuable grid assets.

This need for grid-edge integration reflects the grid’s rapid evolution. From one-directional, to bi-directional with DERs, it is now becoming multi-directional, with energy flowing dynamically across a multitude of nodes. Managing this system requires advanced forecasting, digital control tools and closer collaboration between utilities, governments and private providers.

According to the utility respondents in the study conducted by S&P Global Market Intelligence 451 Research, utilities now rank VPPs, microgrid segmentation, DER integration and vehicle-to-grid programs among their top priorities. Embracing grid-edge integration enables utilities to transform complexity into opportunity, aligning decentralized resources with the broader goals of resilience, decarbonization and long-term grid reliability.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.