Source: Thomas Winz/Stock Photos | Pick-up Truck/via Getty Images.

Driverless trucks look poised to be more common on the roads as autonomous mobility organizations extend collaborative efforts with their technology partners. Together, these organizations are expected to deploy autonomous trucking solutions, an innovation that promises to address critical issues like driver shortages and operational inefficiencies.

In the first of this two-part blog post series, we’ll be sharing autonomous trucking technology market trends, adoption and potential use cases.

Autonomous trucking technology market trends

Autonomous trucks use technologies based on perception, analysis, planning and decision-making. These vehicles are equipped with a range of sensors, including localization sensors, high-definition maps, cameras, LiDAR (light detection and ranging) and connectivity systems. Artificial intelligence (AI) plays a key role in processing sensor data, enabling real-time decision-making and boosting the overall efficiency and safety of autonomous trucks.

The Society of Automotive Engineers (SAE) International created the SAE J3016 standard, which outlines six levels of driving automation, ranging from Level 0 (no automation) to Level 5 (full automation). The advent of end-to-end autonomous driving technologies, also known as AV 2.0, will likely enhance autonomous trucks with AI models that adapt to various road scenarios, pushing toward scalable, reliable services. Classified as SAE Level 4, these trucks operate without human intervention.

Currently, a trend we’re seeing in the autonomous trucking technology market is a focus on highly automated driving (HAD) trucks, which offer easier integration with existing operations. HAD trucks, equipped with a SAE Level 3 advanced driver-assistance system (ADAS), handle most tasks autonomously but need human oversight, reducing total cost of ownership, improving uptime and addressing driver shortages.

Adoption of autonomous trucking technology

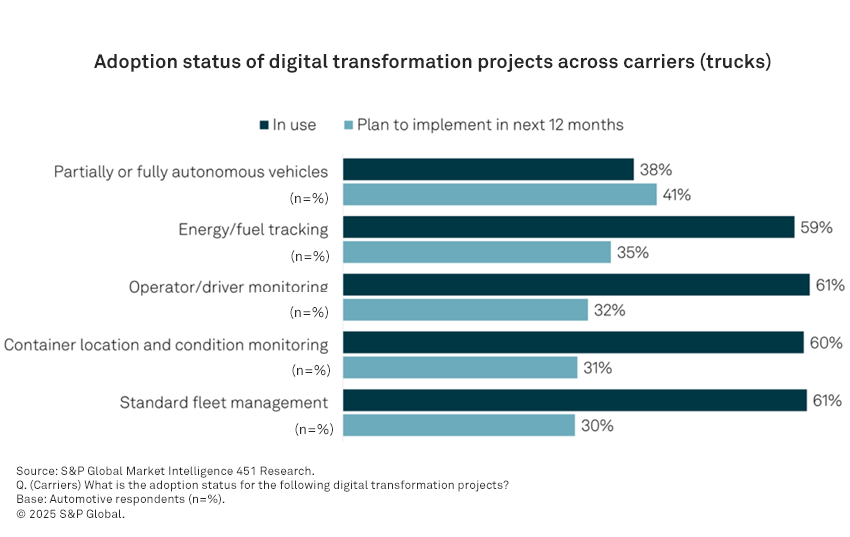

According to a survey conducted by S&P Global Market Intelligence 451 Research, deployment plans for autonomy technology among carriers are currently lower than other digital transformation projects. However, over the next year, partial or full vehicle autonomy projects are expected to be deployed by an additional 41% of respondents.

This shift is driven by the pressing need to address the shortage of truck drivers and the benefits autonomous trucks offer, such as reduced maintenance, 24/7 operation, improved fuel efficiency and optimized total cost of ownership.

Use cases for autonomous trucks

The applications of autonomous trucks span multiple sectors, including logistics, construction, mining, urban transportation, government and agriculture. These vehicles are optimized for highway driving and long-haul routes, prioritizing fuel efficiency, reliability and safety mechanisms due to their larger size and potential cargo. Additionally, they often incorporate advanced fleet management and logistics systems to reduce operational costs.

Key use cases include:

- Long-haul hub to hub: Involves moving goods between major distribution centers over long distances, typically on highways, with predictable routes and fewer complex driving conditions. Companies like Volvo Car AB and Torc Robotics are developing autonomous offerings for this segment.

- Mid-distance hub to hub: Covers shorter routes between regional distribution centers, facing more varied driving conditions compared with long-haul routes. Vendors such as Scania are exploring autonomous tools for mid-distance hub-to-hub transport, aiming to enhance efficiency and minimize costs.

- Mid-distance point to point: Focuses on direct routes between two locations without intermediate hubs, requiring flexible autonomous systems capable of handling diverse road conditions and traffic patterns.

- Intra-city distribution: Involves the delivery of goods within urban areas, including waste collection and other municipal services. This scenario is complex due to dense traffic, frequent stops and varied road conditions.

- Closed environment: Occurs within confined areas such as container terminals, military settings, agricultural hubs, logistic hubs, airports and ports. These environments are well-defined and controlled, making them ideal for the application of autonomous vehicles.

Stay tuned for part two of this blog post series where we share the actionable insights that are vital to scaling autonomous trucking technology, as well as potential challenges in this space., reflecting the complexities of the current economic environment.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.

This content may be AI-assisted and is composed, reviewed, edited and approved by S&P Global in accordance with our Terms of Service.