Source: SinghaphanAllB/Moment via Gettyimages .

Organizations are recalibrating their priorities in IoT connectivity, elevating security and performance over cost as decisive factors in choosing providers and preferred network technologies.

Nearly half of respondents identify security as their top criterion for selecting a provider, while 39% adopt multi-provider strategies to ensure flexibility and redundancy.

These findings, drawn from a study conducted by S&P Global Market Intelligence 451 Research, underscore a central theme: Connectivity is evolving beyond basic device linkage into a strategic foundation for secure, scalable and intelligent ecosystems that can support bandwidth-intensive applications and edge-driven innovation.

The Take

Organizations are signaling a clear mandate: Connectivity providers must move beyond basic transport and deliver integrated, value-added capabilities. Security and life-cycle management are no longer optional — they are differentiators, with nearly half of respondents ranking security as a top selection criterion and over one-third prioritizing onboarding and troubleshooting support. Vendors should also anticipate multi-provider strategies, which 39% of organizations already employ, by enabling interoperability and streamlined integration. Next-generation technologies such as 5G Full NR and 5G RedCap (short for reduced capability) present opportunities, but affordability and road map clarity remain critical barriers. Addressing these concerns through transparent pricing and migration paths will accelerate adoption. Finally, edge processing and AI integration are emerging as baseline expectations, positioning connectivity as part of a broader intelligent infrastructure. Providers that align with these imperatives will be best placed to capture organizations’ trust and long-term relevance.

Summary of findings

Security and performance dominate provider selection. Overall, 48% of respondents cite security posture and network reliability as top factors when choosing IoT connectivity providers, ahead of cost considerations. Organizations view connectivity as a strategic enabler, where resilience and protection take precedence over short-term savings. Providers that fail to prioritize security and uptime risk losing relevance as IoT deployments scale into mission-critical operations.

Multi-provider strategies reflect demand for flexibility. About 39% of organizations use multiple regional or use-case-specific providers, compared with 19% relying on a single global provider. This fragmentation indicates that organizations prioritize localized optimization and redundancy over uniform global coverage. Connectivity vendors must coexist in multi-provider ecosystems, offering interoperability and simplified integration to remain competitive.

Connectivity platforms are now table stakes. About a third (32%) of respondents rank connectivity management platforms among the most important value-added capabilities that providers offer, alongside integrated security and analytics tools. This highlights a shift toward holistic offerings that simplify life-cycle management and reduce operational complexity. Vendors that fail to deliver robust platforms risk being perceived as commodity providers rather than strategic partners.

Life-cycle management capabilities are critical for IoT success. Connectivity troubleshooting, cloud integration and device onboarding top the list of desired life cycle features, each cited by more than 37% of respondents. These priorities underscore the operational burden of managing distributed IoT endpoints and the need for automation and visibility. Organizations will increasingly favor providers that embed life-cycle automation, reducing total cost of ownership and accelerating time-to-value.

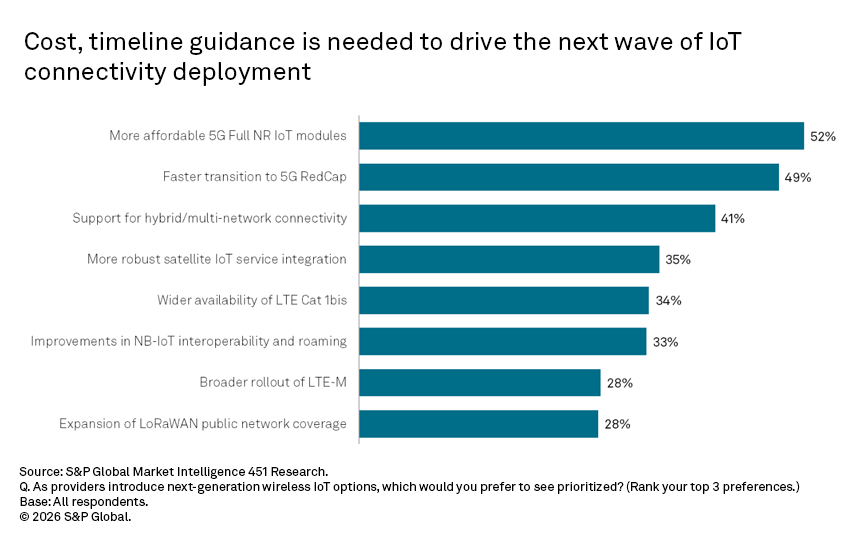

Next-gen connectivity priorities center on affordability and hybrid models. More than half of respondents want affordable 5G Full NR modules prioritized, followed by faster transition to 5G RedCap and support for hybrid cellular-satellite connectivity. This reflects a dual push for cost efficiency and coverage diversity as IoT scales globally (see Figure 1). Vendors that can balance performance with affordability will capture early adopters and drive broader market penetration.

Concerns about future-proofing are slowing next-generation adoption. Top barriers include uncertainty around technology road maps (37%) and high device costs (31%), as well as integration complexity and ROI challenges. While interest in advanced connectivity is strong, organizations remain cautious about long-term viability. Providers must address these fears through transparent road maps and flexible pricing models to accelerate migration.

Bandwidth requirements are trending upward. While low-bandwidth use cases remain common, 17% of organizations report that most of their IoT deployments require high bandwidth (10 Mb/s or faster). This shift signals growing adoption of video, edge analytics and other data-intensive applications that demand robust connectivity. Networks optimized for high throughput and low latency will become essential for competitive differentiation.

Edge and AI integration expectations reshape provider roles. More than 50% of respondents expect providers to enable secure data processing at the edge and 42% want AI-capable platforms. This evolution positions connectivity vendors as partners in distributed intelligence rather than mere network operators. Providers that fail to integrate compute and AI capabilities risk being sidelined as organizations seek end-to-end IoT solutions.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.