Source: bjdlzx/iStock/Getty images.

According to a study conducted by S&P Global Market Intelligence 451 Research, reliability remains the foremost selling point for colocation, with disaster recovery capabilities and improved uptime emerging as strategic priorities for existing customers. While more than half of surveyed colocation users plan to incrementally increase their space over the next two years, a distinct subset is aggressively scaling up to capitalize on colocation benefits. These and other trends are evident in the survey results, which looks at the appetite for colocation services, including motivations and requirements, expansion and reduction plans, and adjacent services.

The Take

S&P Global Market Intelligence 451 Research’s recent study offers valuable insights for leased data center providers. First and foremost, more than one-fourth of existing colocation customers plan to expand their footprints to accommodate latency-sensitive workloads, marking a notable change from past studies in both the expansion opportunity and the motivating use case. This intent to expand is echoed in other custom studies we have conducted. The study also reflects increased interest in managed services, as well as a new emphasis on GPU as a service and capacity planning.

As in other years, this study also indicates that many organizations find no value in colocation. We continue to see this as a missed opportunity for the colocation industry, as many of the reasons that companies cite for not using colocation are refuted by the key selling points cited by colocation users.

Summary of findings

Reliability is the key selling point of colocation. Among organizations that use colocation, improving reliability (42%) remains the top reason for using these services, followed by disaster recovery (32%). The survey shows a 9-percentage-point drop year over year in the proportion of organizations citing interconnection with service providers (25%). However, this decline likely reflects a shift in emphasis rather than a reduction in importance. Meanwhile, we note an 8-point increase in the percentage of organizations saying they use colocation to meet regulatory or compliance requirements. This trend reflects the growing relevance of localization and sovereignty considerations, and suggests organizations are transferring risk associated with ever-changing regulatory environments to their colocation providers.

Colocation footprints continue to grow incrementally, with pockets of acceleration. Overall, more than half (56%) of organizations using colocation plan to increase the amount of space they use over the next two years. This marks an incremental uptick from the 2024 survey (53%). Within this group, the proportion planning to dramatically increase their colocation space has doubled year over year (15%; up 7 points). This shows that while most organizations that use colocation are taking a gradual approach to expansion, there is a segment of organizations jumping in with both feet.

Organizations are turning to colocation to address latency issues. Among the key drivers for expanding colocation space, improving latency (26%) shows an 8-point increase. This is now tied as the top motivating factor, along with improving reliability (26%), which decreased 10 points year over year. In the broader list of motivations, GPU as a service (15%) falls in the middle of the pack. Similar to the findings above, we note a decline in the subset of organizations citing interconnection with service providers (13%; down 9 points). However, categories showing year-over-year declines again appear to reflect shifting focus, rather than reduced importance of these services.

Some organizations still do not see value in colocation. As in previous surveys, there is a contingent of organizations disinterested in colocation. Among this group, the largest proportions believe it costs less to run their own in-house facilities (35%), do not identify any value in using colocation (30%) or believe they have enough capacity in their enterprise data centers (28%). These are the same top reasons as in our 2024 survey.

More organizations are using managed services. Among a list of services available from colocation providers, nearly every category is in broader use compared to our year-ago survey.

The most widely used services are public cloud management (42%; up 12 points), managed private cloud (41%; up 6 points) and network procurement (39%; up 9 points).

These near-universal increases align with greater adoption of managed services among organizations that use colocation. In the current survey, 92% of colocation users report leveraging at least one managed service, up from 80% in the 2024 survey. This highlights the importance of add-on services to the value proposition of colocation.

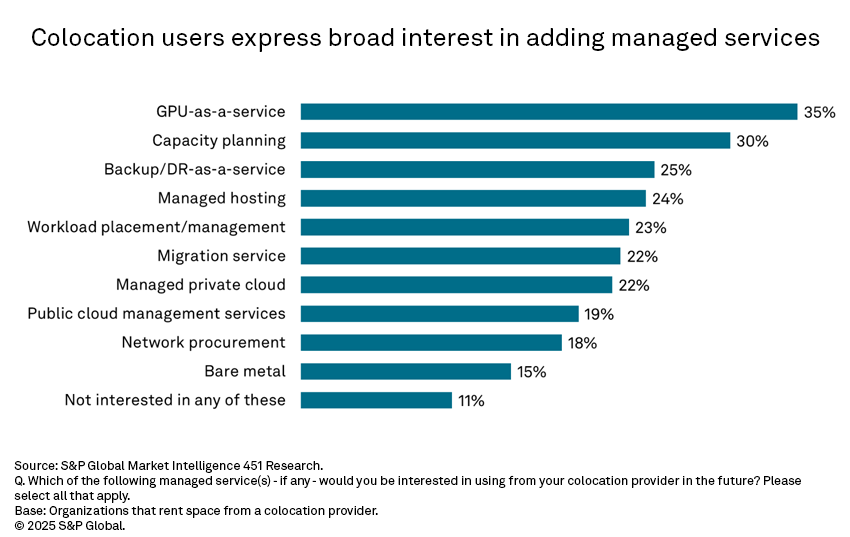

Projected uptake of managed services is also strong. The survey also asked respondents about managed services they would like to use in the future. GPU as a service (35%) tops the list, followed by capacity planning (30%). Similar to the trend among managed services in use, category-specific increases reflect a broader uptick in overall interest in these services. In the current survey, 89% of colocation users say they are interested in adding services, up from 77% in 2024.

Want insights on datacenter trends delivered to your inbox? Join the 451 Alliance.