Source: S&P Global Employees/S&P Global.

The consumer smartphone market is showing signs of resilience despite significant economic headwinds. Over the next six months, consumers are more likely to purchase a new smartphone than they were at this point a year ago. Apple is the biggest beneficiary of this increase in planned buying; its latest iPhone model is already selling better than expected, according to multiple news outlets. While this may seem counterintuitive given the current economic climate, it’s likely due, at least in part, to consumer fears that if they wait too long, tariffs and/or inflation could push the price of these devices even higher.

This blog post presents findings from a survey conducted by S&P Global Market Intelligence 451 Research, which asked US consumers about their current smartphone ownership, customer satisfaction and intent to purchase.

Key takeaways from the survey

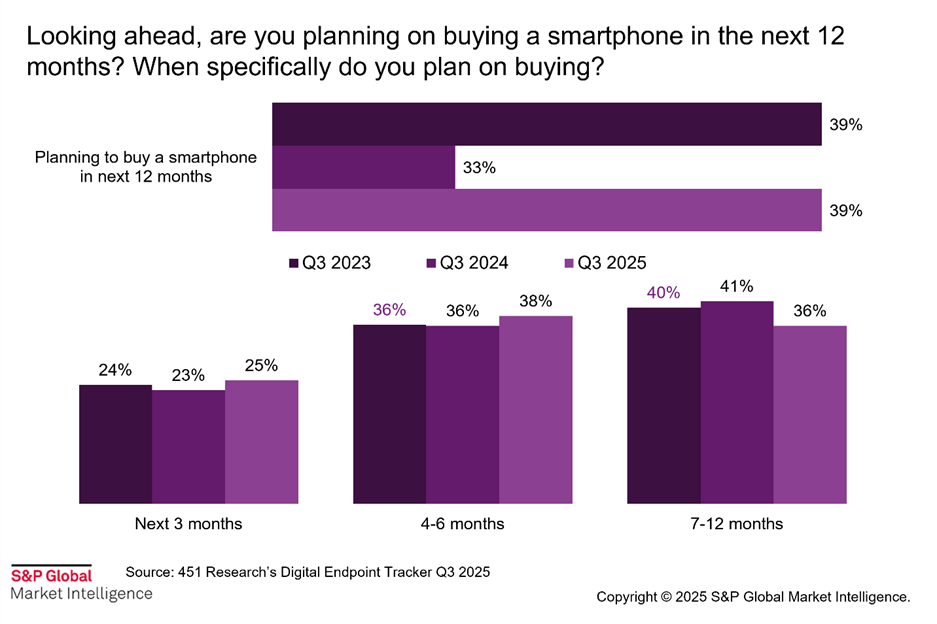

Smartphone buying jumps year-over-year. Planned smartphone buying over the next 12 months is up compared to the 2024 survey, from 33% back to the same 39% seen in our third-quarter 2023 survey. There’s also an increase in the number of respondents saying they plan to purchase their new phone within the next six months, which indicates greater purchase urgency compared to 2024 as well. Part of this urgency is attributable to the current economic environment, where consumers are greatly concerned that tariffs will make consumer electronics more expensive.

Apple is responsible for a majority of planned buying. Another key factor in the current uptick in planned buying is the launch of Apple’s latest iPhone. The new device was released in September to strong demand.

As the survey highlighted, 52% of planned smartphone buyers said they would be buying an Apple, which is up 8 points compared to the third-quarter 2024 survey. As a result, Samsung’s share of planned buying dropped from 33% in the third quarter of 2024 down to 29% in the current survey.

Interestingly, the number of respondents who were unsure of which phone they would buy also declined year-over-year.

Higher-income households are fueling most of the increase in buying plans. Overall, higher-income households (more than $100,000 per year; 55%) are more likely to buy a new smartphone over the next 12 months than lower-income ones (less than $50,000 per year; 33%). They are showing a 16-point increase year-over-year compared to lower-income households, who show only a 1-point increase. Similar to 2024, the percentage of planned buyers who say they will make their purchase within the next three months is nearly the same between higher-income (27%) and lower-income (25%) households, but that is where the similarities end.

Looking further out, a higher percentage of planned buyers from lower-income households (38%) are delaying their purchases 7-12 months compared to higher-income households (31%).

Income also influences brand selection. Household finances not only influence whether consumers are able to buy new devices, but also which brands they can reasonably afford. Looking at current owners, higher-income households (61%) own Apple smartphones at a much higher rate compared to lower-income ones (40%). Likewise, a greater number of lower-income households (37%) own Samsung smartphones than higher-income ones (28%). Lower-income households (12%) also use Motorola phones at a much higher rate (4%).

Satisfaction still matters. Apple (75%) continues its years-long trend with the highest percentage of smartphone owners saying they are very satisfied with their device. Samsung (71%) and Google (68%) continue their trend of flip-flopping for second and third. Beyond this triumvirate, the next closest manufacturer is Motorola, at 60%. The top performers in customer satisfaction usually equate to leading market positions, and this is the case for Apple and Samsung. However, Google continues to be a notable exception, never being able to convert its relatively high satisfaction rates into a commensurate share of the smartphone market.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?